All Categories

Featured

Table of Contents

This five-year basic rule and 2 adhering to exceptions apply only when the proprietor's death triggers the payout. Annuitant-driven payouts are discussed listed below. The initial exception to the general five-year guideline for individual beneficiaries is to approve the survivor benefit over a longer duration, not to go beyond the expected life time of the recipient.

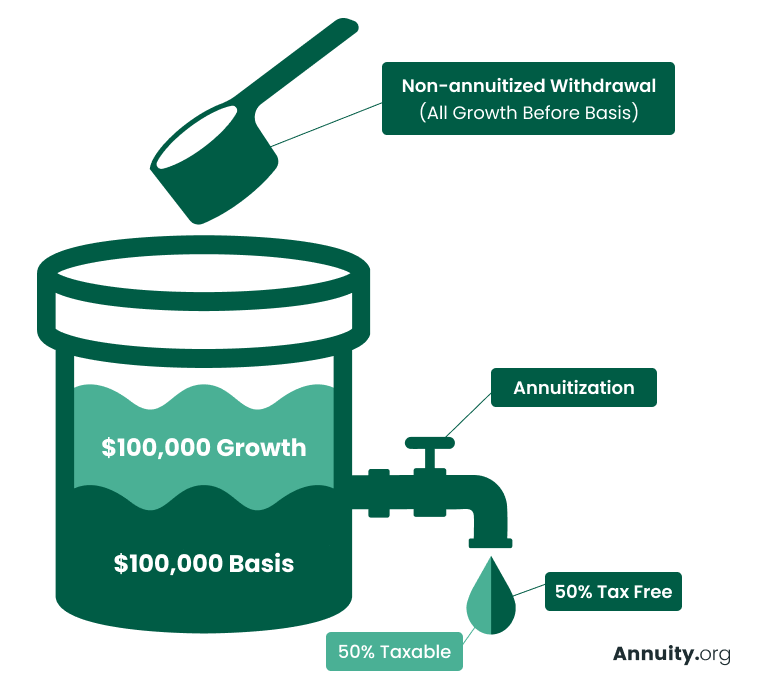

If the recipient elects to take the fatality advantages in this technique, the benefits are taxed like any kind of various other annuity settlements: partly as tax-free return of principal and partially taxed revenue. The exemption ratio is located by utilizing the deceased contractholder's expense basis and the anticipated payouts based upon the recipient's life expectancy (of shorter duration, if that is what the recipient picks).

In this method, often called a "stretch annuity", the beneficiary takes a withdrawal each year-- the needed quantity of every year's withdrawal is based upon the exact same tables used to calculate the needed distributions from an individual retirement account. There are 2 advantages to this technique. One, the account is not annuitized so the beneficiary preserves control over the cash money value in the agreement.

The second exemption to the five-year guideline is available just to a making it through partner. If the designated beneficiary is the contractholder's partner, the partner may choose to "tip into the footwear" of the decedent. Effectively, the spouse is dealt with as if he or she were the owner of the annuity from its inception.

Do you pay taxes on inherited Annuity Beneficiary

Please note this uses only if the partner is called as a "assigned recipient"; it is not readily available, for example, if a trust fund is the beneficiary and the spouse is the trustee. The basic five-year regulation and both exemptions just relate to owner-driven annuities, not annuitant-driven contracts. Annuitant-driven agreements will pay survivor benefit when the annuitant passes away.

For functions of this discussion, assume that the annuitant and the proprietor are different - Flexible premium annuities. If the agreement is annuitant-driven and the annuitant passes away, the fatality triggers the survivor benefit and the beneficiary has 60 days to determine how to take the death benefits subject to the terms of the annuity contract

Note that the choice of a partner to "tip right into the footwear" of the proprietor will not be offered-- that exception applies just when the proprietor has passed away but the proprietor really did not pass away in the circumstances, the annuitant did. If the beneficiary is under age 59, the "death" exemption to stay clear of the 10% charge will certainly not apply to a premature circulation once again, since that is readily available just on the death of the contractholder (not the death of the annuitant).

Several annuity companies have interior underwriting policies that refuse to provide agreements that name a different proprietor and annuitant. (There might be odd scenarios in which an annuitant-driven contract meets a clients special needs, yet usually the tax downsides will exceed the benefits - Index-linked annuities.) Jointly-owned annuities might posture similar problems-- or a minimum of they might not serve the estate preparation feature that jointly-held properties do

As an outcome, the survivor benefit have to be paid out within five years of the initial proprietor's death, or subject to the 2 exemptions (annuitization or spousal continuation). If an annuity is held jointly in between a hubby and wife it would certainly appear that if one were to die, the other might just proceed ownership under the spousal continuance exemption.

Assume that the husband and other half named their son as recipient of their jointly-owned annuity. Upon the death of either proprietor, the company has to pay the fatality advantages to the kid, that is the recipient, not the making it through spouse and this would most likely defeat the owner's intents. Was really hoping there may be a device like establishing up a recipient Individual retirement account, but looks like they is not the case when the estate is arrangement as a beneficiary.

That does not recognize the kind of account holding the acquired annuity. If the annuity remained in an inherited IRA annuity, you as administrator must be able to assign the inherited individual retirement account annuities out of the estate to inherited Individual retirement accounts for each estate recipient. This transfer is not a taxable occasion.

Any circulations made from inherited IRAs after job are taxed to the beneficiary that got them at their normal earnings tax rate for the year of circulations. Yet if the inherited annuities were not in an IRA at her fatality, after that there is no way to do a direct rollover into an inherited IRA for either the estate or the estate recipients.

If that occurs, you can still pass the circulation through the estate to the private estate beneficiaries. The income tax return for the estate (Kind 1041) might include Form K-1, passing the revenue from the estate to the estate beneficiaries to be tired at their private tax rates rather than the much higher estate income tax prices.

Are Annuity Cash Value death benefits taxable

: We will create a plan that consists of the most effective items and attributes, such as enhanced survivor benefit, premium rewards, and irreversible life insurance.: Get a customized strategy made to optimize your estate's worth and decrease tax obligation liabilities.: Implement the chosen method and receive continuous support.: We will certainly aid you with establishing the annuities and life insurance coverage policies, giving constant guidance to ensure the strategy stays reliable.

However, ought to the inheritance be regarded as an income associated with a decedent, then tax obligations might use. Normally talking, no. With exemption to pension (such as a 401(k), 403(b), or IRA), life insurance policy profits, and savings bond interest, the beneficiary generally will not have to bear any type of earnings tax on their inherited wealth.

The amount one can acquire from a trust without paying tax obligations depends on numerous variables. Specific states may have their own estate tax laws.

His objective is to streamline retirement preparation and insurance policy, making sure that clients understand their selections and secure the finest insurance coverage at unequalled prices. Shawn is the creator of The Annuity Expert, an independent online insurance coverage company servicing consumers across the United States. Via this platform, he and his team aim to get rid of the uncertainty in retirement planning by aiding individuals locate the very best insurance policy coverage at one of the most competitive rates.

Table of Contents

Latest Posts

Exploring Fixed Index Annuity Vs Variable Annuities A Comprehensive Guide to Investment Choices Defining What Is Variable Annuity Vs Fixed Annuity Advantages and Disadvantages of Different Retirement

Decoding How Investment Plans Work Everything You Need to Know About Financial Strategies What Is Variable Annuity Vs Fixed Indexed Annuity? Benefits of Choosing the Right Financial Plan Why Variable

Decoding Fixed Vs Variable Annuity Pros And Cons A Comprehensive Guide to Investment Choices Breaking Down the Basics of Investment Plans Pros and Cons of Fixed Indexed Annuity Vs Market-variable Annu

More

Latest Posts